The Budget

What do you think about when you hear the word budget? To most, the word budget is not a nice word, equated to restriction and a lack of fun and joy. In reality, a budget is a guide for your money.

A budget allows you to no longer stress over the uncertainty of not having a plan for your money. Have you ever taken money out of the ATM, only to wonder a few days later, where it all went? A budget eliminates that wondering and replaces it with knowledge.

My system uses 2 budgets one that utilizes the zero-based budget concept and one that does not.

The Zero-Based Budget

The concept of a zero-based budget is simple. Each month, your goal is to plan how you’re going to “spend” all your income. Your goal is to get your budget to “zero”. An equation to represent this approach would look like this:

Income – Expenses = Zero

You have 2 budgets? Are you crazy?

Yes I may be crazy, but hear me out. I found that based on my personality I would need a budget that was static. As well as one that could change throughout the month. By having 2 budgets I was able to achieve two things.

- I was able to plan for the month ahead, before the first check of the month.

- I was able to compare the static budget with the flexible budget to see if any changes had occurred. Was there a bill I missed during the initial budgeting? Am I putting enough away for unexpected expenses? One budget could answer these questions over time. 2 budgets can answer these and other questions much more quickly.

So how do I get my budget on?

I’m glad you asked. My first step is to set up my monthly budget using my fixed budget.

-

First, I list all my income sources for the month.

This includes paychecks, small-business income, side jobs, residual income and so on. I use my fixed budget for this.

-

Then I pay myself first.

By listing all my saving goals, I make sure that get funded before I pay my expenses. This means I have no excuse to save.

-

Next, I list every expense I have for the month.

Rent, food, cable, phones and everything between gets added to the list. I separate my expenses between fixed, variable and irregular.

Fixed: For fixed expenses, I enter them as they are.

Examples of fixed expenses: rent, loan payments.

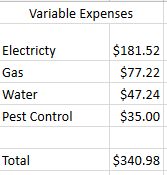

Variable: For variable expenses I take the average of 3 – 12 months of the expense.

Examples of variable expenses: utilities.

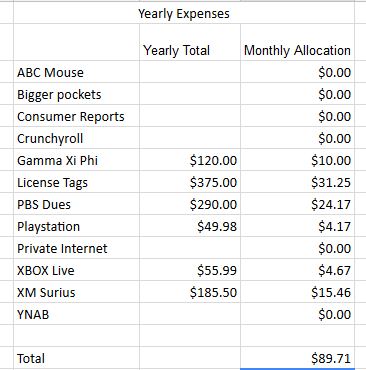

Irregular: I take the total amount of the expense and divide it by the frequency that it is due.

Example, yearly expenses I divide by 12, quarterly expenses, I divide by 4.

-

Subtract your income from you expenses.

Finally I subtract my income from my expenses, savings and giving. Whatever left, I split 90/10 between debt paydown and investing.