Debt Payoff Report June 2017

Debt Payoff Report June 2017. This month was very good. The bi monthly debt pay down distribution hit my current debt. The financial freedom distribution also hit my current debt as well. I love when both of my distributions hit my debt at the same time. Repayment of the Home Repair category money I took out for some auto maintenance is ongoing. Still I was still able to put a decent dent in one of my debts.

My debt pay down strategy

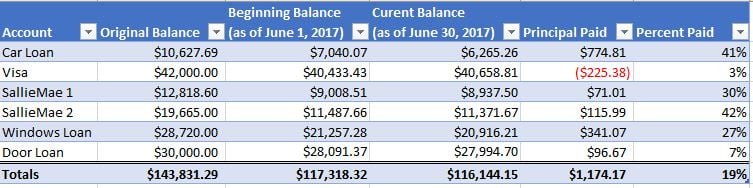

And now for the numbers

Car Loan: Received a good boost this month. This was due to both the debt pay down category and the financial freedom distribution used. The total paid on this loan was $814.

Visa: This credit card is still used. I know it is in complete opposition to most other strategies. Not using credit cards is a very good idea. I make a point of paying off all purchases I make as well as the minimum payment. Until I pay off the car loan, some months will not pan out as planned.

Sallie Mae 1, 2, and Windows Loans: Nothing to see here. Paid my regular monthly payment and I’m watching the principal go down every month.

Door Loan: I want to talk a little bit about this loan because you can see that the principal paid is very low. When I opened this loan, I had the beginning payment deferred for a few months. When I began paying, I was paying only interest that was accruing every month until I began paying it. Live and learn. If you can, never defer payments. I should have been more patient. I should not have taken a loan out untill I was in a better position to make payments right away.

Next Month’s Goal

My goal next month is to get that Visa debt back in order. I’ll take a look at my spending on that card to see what changes can be made.

What changes are you making to get a handle on your debt?